Business is about pursuing both profit and growth.

Either of which is very difficult to achieve. You would be best served if you choose to ignore growth until you prove yourself profitable. It’s good advice.

Why ignore growth until you can turn a profit?

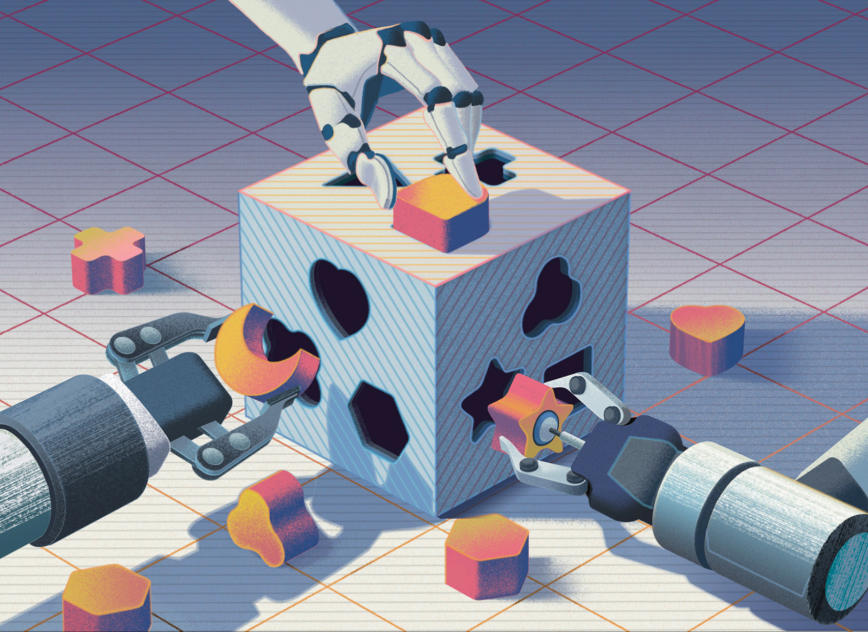

There is a theory of Good and Bad Capital. In Clay Christensen’s book, How Will You Measure Your Life? Christensen points out that 93 percent of all companies that become successful had to abandon their original strategy. Companies don’t succeed because they have the right strategy at the beginning, its because they have enough money left after their first strategy fails.

Those companies that do fail usually spend all their money on their first strategy.

Good capital is patient for growth and impatient for profit.

It demands that a new company finds a way to be profitable with as little investment as possible – so that the entrepreneur doesn’t spend a lot of money pursuing the wrong strategy.

Bad capital is capital that demands a business grow really big really fast, and almost always drives the business off a cliff. Big companies burn through cash faster, and big companies find it very difficult to change strategy compared to smaller ones.

That is why capital that demands growth without first seeing profit is bad capital.

Businesses that are looking for capital to scale should only do so when their business model and assumptions are proven correct on a small scale.

As an aside: Lean, Agile, Iterative. Its all about failure. That’s what these seemingly new buzzwords are. The difference between the winner and loser? The winner fails fast and fails cheaply. The winner pushes through the dip of failure and iterates his way to success while keeping his powder dry.

Andrew Spring from Jirsch Sutherland points out,

“Cashflow is important and may be the most important, but at the end of the day, your aim is to make a profit. There is simply no point in having growth without keeping the profit in mind. If you miss out on an opportunity, you will live to fight another day if you are making money. I have a client with a business that has a $15m turnover but with a $1.5m loss. He chased work and simply underquoted, they had a couple of delays and whammy it’s all over. You liken it to margin lending, you can make a lot of money by rapidly scaling up. However, things go bad real quick when they turn against you. Having high growth without a solid profit underpinning the growth just magnifies the downside…… Growth is great, it doesn’t mean anything unless you are making a profit – just means you are wearing bigger pants.“

A lot of people they run before they walk, take truckies, for example, the owner-driver gets one truck and makes money. Then he thinks he can have 50 trucks and make 50 times more money.

Thing is, it’s a whole different ball game at the higher level. Not only is it about growing after you’re profitable, but growing at a rate that maintains a certain level of profit and doing it gradually. Transition into being a bigger business slowly, and give yourself and your business time to adjust to the challenges.

In order to grow at an outstanding rate organically, you have to be doing something pretty cool. Doing something cool is usually, for most businesses, with the exception to the rule.

If most small businesses just focussed on being profitable, rather than gearing up for growth, less of them would be taken out of the game.”

People need to be proven profitable just like a business.

Forcing smaller businesses to find a profitable business model just doesn’t apply in speculative high tech industries. It applies to well-established business models. Even though some business models have been proven since forever, the people running them have not.

You can have the best possible resume in your industry going, but a resume won’t guarantee exactly how a person performs in particular conditions. For example, some CEOs can perform very well at one company and then completely bomb out at another.

Unless the person or team running the operation can prove to you they have a profitable track record running the actual business, then it is best to let the reality of the commercial world prove them before you invest. In other words, you want the person or team to prove themselves successful in the actual business to truly believe it can work.

This is the reason why, even when you have a proven track record and you start a new business, a bank will not fall over itself to finance you. Don’t be surprised when a lender seemingly couldn’t give a toss about your resume.

Being profitable in business is like being popular back in high school.

“A lot of advisors think you get external equity first, then debt second. It’s better to get a debtor finance facility in place, get some runs on the board, get profitable and growing then approach private equity for capital. Not the other way around.” – Stephen Hodgkinson.

Let’s face it, financiers are for the most part fair weather friends. We really only want to jump on the wagon when things look good. When you think about it, isn’t that the same for everybody in business? Who wants to do business with people when it is too risky, difficult, and not profitable?

If you flip this around and look at it from another angle: This means what you need to do in business to get friends is be super profitable. The more profitable you are, the more friends you will have.

Just like everybody wants to hang around the popular kid in the hope of becoming popular themselves, businesses want to associate with you because they know they will get a piece of the action. Suppliers will give you better pricing, better terms and better service when they know you will have the money to pay.

From a finance perspective, having solid profits means you are a low-risk investment. Financiers adjust their pricing for risk, this means you can get your money at the cheapest possible cost to your business. So yes just like any other supplier, your financier will want to be your ‘friend’ and will discount his margin accordingly.

The end result is that the more profitable you are on a small scale, the more profitable you will be when you scale up as the cost of everything drops due to your desirability to do business with.

When you are not profitable and are having problems, nobody wants to do business with you. In order to get suppliers, you need to pay a premium. This premium can take the form of higher pricing, or crappy supply terms. Both result in a higher need for working capital. As your cost of business skyrockets, it becomes self-perpetuating, and the next thing you know you are out the door backward.

One definition of happiness is spending at least 1 dollar less than you earn.

Now we can all point to many a case study that shows the Googles, Amazons, and Facebooks of this world making huge losses before they turn a profit, but there are always exceptions to the rule. For us mere business mortals, it’s best to stick with the basic principles of business.

See if Stak can finance your supply chain

. . .

We regularly share our thoughts on trade finance, lending, company culture, product strategy and design.

Stak works with clients that sell to some of the largest buyers in Australia & overseas.